- Why Enthuse?

-

Solutions

Donations

Branded payment solution for regular and one-off digital donations

Fundraising and Events

Custom all-in-one branded fundraising and event registration solution

Fundraising

Digital fundraising and appeal pages customised to your charity’s cause

Mass Participation

Set up official fundraising pages for the UK’s biggest challenge events like the TCS London Marathon

Event Registration

Comprehensive and customisable ticketing and event registration

MorePremium -

Resources

- Careers

- Support

- Pricing

- Login

-

Accepting online donations made easy

Easy

Branded

Gift Aid

Reporting

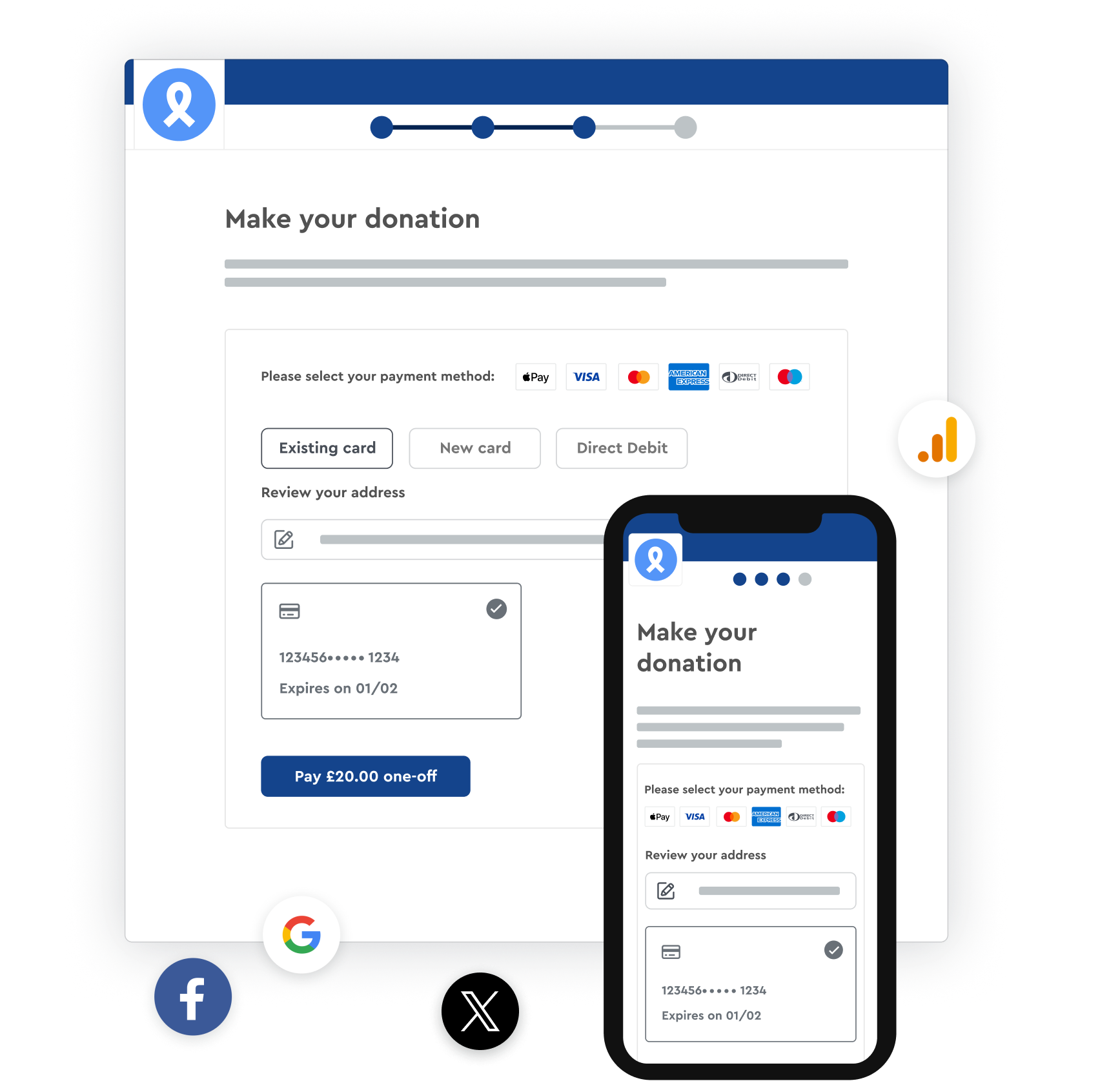

An easy donor journey for supporters to increase donations

Social logins

Increase conversions and shorten the supporter journey with Facebook and X log-in options.

Postcode lookup

Painless and rapid address entry for your supporters. Accurate data for your CRM.

Guest checkout

Reduce donation process abandonment by allowing your supporters to donate as a guest, or remain anonymous.

Custom ‘Thank you’ message

Add your own message to thank donors for their support and choose a custom web address to redirect them to after donating.

Maximise your impact with fully branded donation pages

Your logo and colours

Ensure a consistent user experience with your logos and branding on donation pages. Donations to branded pages are 43% higher than consumer giving platforms. *

Impactful story behind your cause

Customise the way you communicate your mission and its importance when you ask for donations.

Custom donation amounts

Choose your own donation levels and add tangible descriptions to communicate the specific impact each amount can have.

Custom data capture

Personalise donation steps with your own questions and collect the information you need to understand your supporters better.

* Source: Donor Pulse

Creating your custom donation form is easy. Try it now.

Creating your custom donation form is easy. Try it now.

A branded donation page like this can be set up on your website within 48 hours.

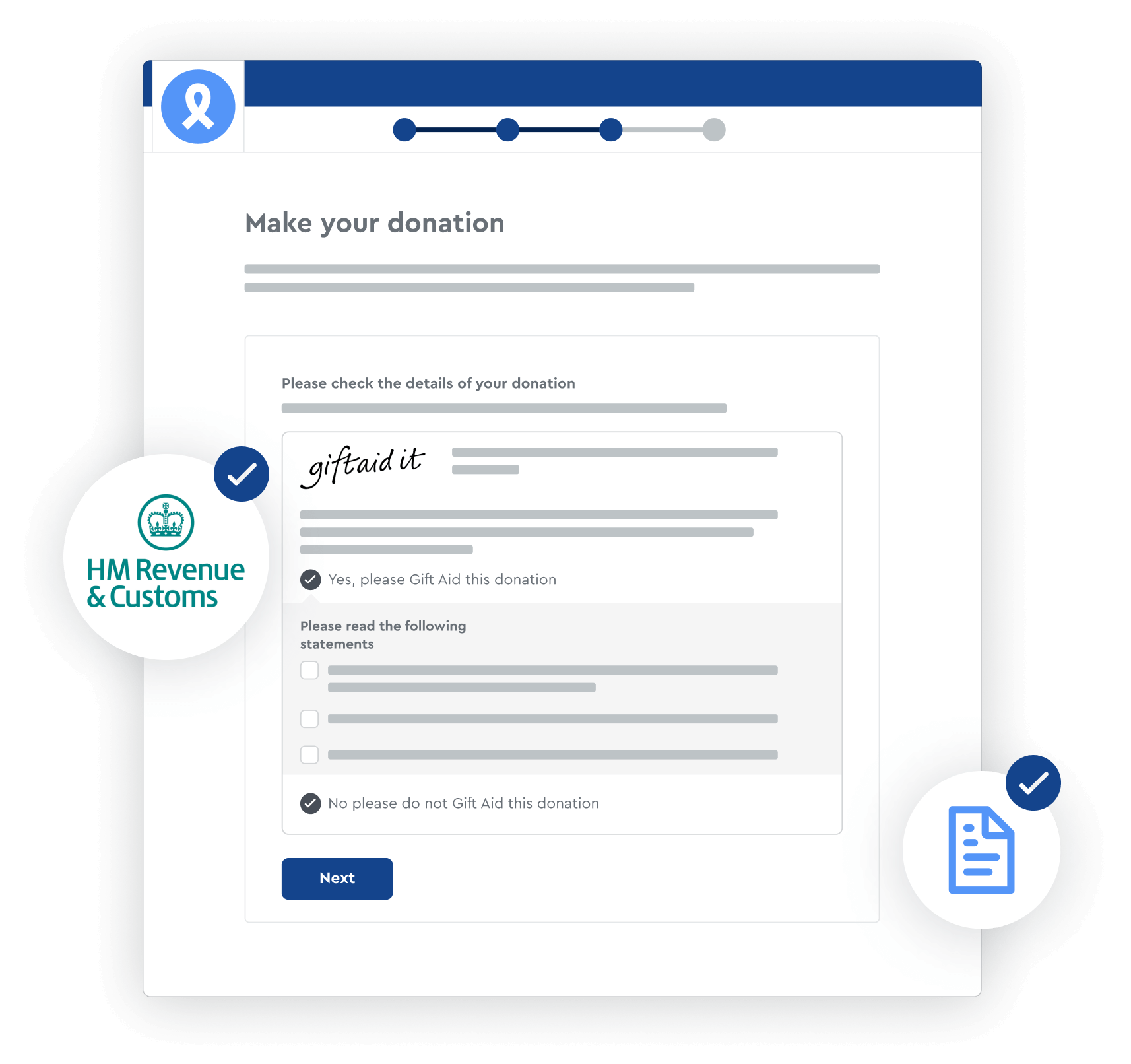

Raise 25% more with Gift Aid

Automatic processing

Save your organisation time and resources, as our donations solution automatically captures and processes Gift Aid information on your behalf.

Maximise Gift Aid donations

Our platform encourages donors to quickly and easily add Gift Aid to their donations, with a dedicated step in the donation process.

HMRC Gift Aid approved agent

Save admin time and get peace of mind. We submit Gift Aid claims on your behalf every month for HMRC to pay to your charity.

Centralised reporting

View all claims and accurately reference HMRC documents against the system.

Stay on top of your donations with centralised reporting

Payments & schedules

See a full breakdown of individual payments and their status as well as recurring payments and Direct Debits set up by your supporters.

Payout reports

Save admin time as we make regular batch payouts to your account and generate reports on all individual payments.

CRM

Use our CRM integrations to make the most out of your donations data and make the best decisions.

Your marketing comms opt-in

Grow your supporter base and manage the way you ask for future communication with your own marketing consent statement.

How we help 80% of the UK’s most loved charities

How Savera UK increased regular donations 10-fold

Savera UK chose Enthuse for online donations and events to deliver better branding and ease-of-use.

Our pricing model

Fees designed for simplicity and the lowest total cost for your charity.

Give our donations product a try

Find out how Enthuse can help you build a donor journey putting your charity first, while retaining control of your data.